Local Incentives

Sales tax

Tate County is a Tier 1 county, therefore, an industry will qualify for a 50% sales and use tax exemption on purchases of component building materials used in the construction or expansion of a building and for the purchase of any new machinery and equipment. Learn more about the Sales and Use Tax Exemption for Construction or Expansion.

State income tax

The formula for calculating the state income tax exemption for job tax credits in Tate County (a Tier I County) is 2.5% of payroll of the company per year for five years. This incentive requires the hiring of no less than 20 new jobs. Learn more about the Jobs Tax Credit.

County and City property taxes

Tate County and cities within Tate County will grant a 10 year tax exemption on all real and personal property except for school taxes that apply. (NOTE: The State of Mississippi does not have state property taxes.)

Also, the county will grant a Freeport Warehouse Tax Exemption on all finished goods that are shipped out of state that qualify. This is a perpetual exemption.

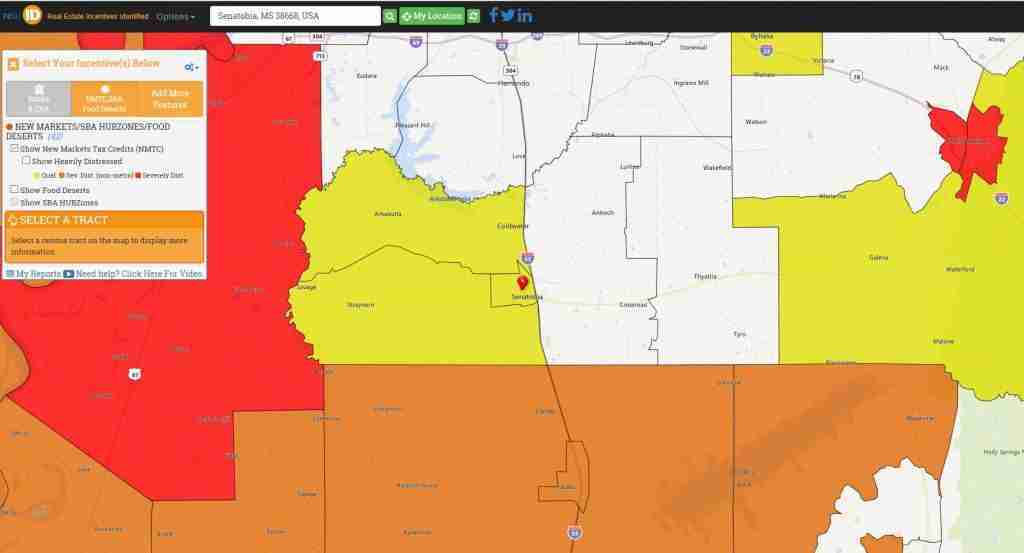

New Markets Tax Credits Zone:

Much of Tate County qualifies for federal New Markets Tax Credits. The New Markets Tax Credit (NMTC) Program incentivizes business and real estate investment in qualified communities of the United States via a federal tax credit.

Opportunity Zone:

Portions of Tate County have designation as a Federal Opportunity Zone. An Opportunity Zone is an federally designated area where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as Opportunity Zones if they have been nominated for that designation by the state and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation of authority to the Internal Revenue Service. More Information one Opportunity Zone benefits is available from the IRS at this site.

Other local incentives are available and are based on job creation and the amount of investment by the company. We will be glad to discuss the details of these incentives with each individual company.

Mississippi Tax Credits, Tax Exemptions, and Incentives

Mississippi offers highly competitive incentives and programs To view all tax credits, visit Mississippi Development Authority’s Financial Resources Division.

Loans and Financing

Learn more about Mississippi Development Authority Grants and Loans Programs here.

Other sources of Financing include

- Delta Regional Authority (DRA)

- USDA Rural Development (RDA)

- North Delta Planning and Development District (NDPDD)

Business Technical Assistance

- Southeaster Trade Adjustment Assistance Center

- Small Business Administration(SBA)

- Mississippi Small Business Development Center (SBDC)

- Mississippi Contract Procurement Center